(The Center Square) – With a total of 137 local school referendum questions spread across ballots in Wisconsin, recent data shows voters’ support for increasing property taxes to fund public education is waning.

137 school referendum questions across Wisconsin could lead to a $4.3 billion increase in school funding. But what does this mean for taxpayers?

Marquette Law School polled 834 registered Wisconsin voters from Oct. 16-24, asking their opinions on presidential candidates, the direction of the state, and public school referendums, among other things.

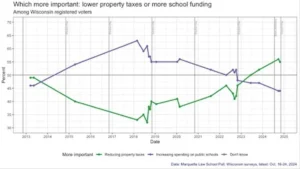

The poll found that voters’ desire to prioritize public school spending over lower property taxes peaked in late 2018, when 57% of Wisconsin registered voters polled said increasing school spending was more important and only 37% said reducing property taxes was more important.

But now, voter support for increasing school district funding has fallen to its lowest level since Marquette began tracking the sentiment in 2013, with only 44% in the most recent survey saying school spending is more important, versus 55% who chose lower property taxes. The change occurs even as voters’ reported satisfaction with Wisconsin schools has returned to November 2023 levels, though not to pre-pandemic levels.

School districts in Wisconsin are subject to a 1993 state law that places limits on how much local governments can increase their property taxes each year. But a district’s property taxes can be raised above the revenue limit through voter-approved ballot proposals.

This past spring, voters across the state approved 62 of the 103 school referendum questions on the ballot, the lowest approval numbers in a midterm or presidential election year since 2010, according to the Wisconsin Policy Forum.