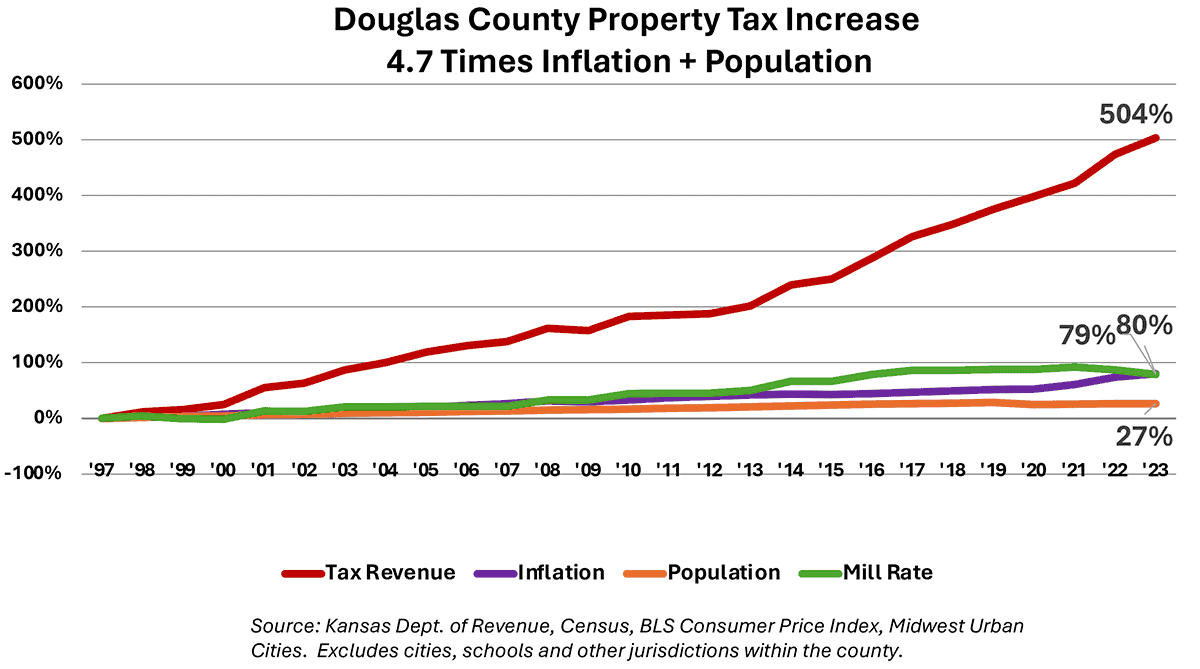

(The Sentinel) — Noting property taxes in Douglas County are up more than 500% in the last 25 years, nearly five times as much as the combined increases in population and inflation, resident Brent Boeve says county leaders are not providing taxpayers answers to their questions about the county budget.

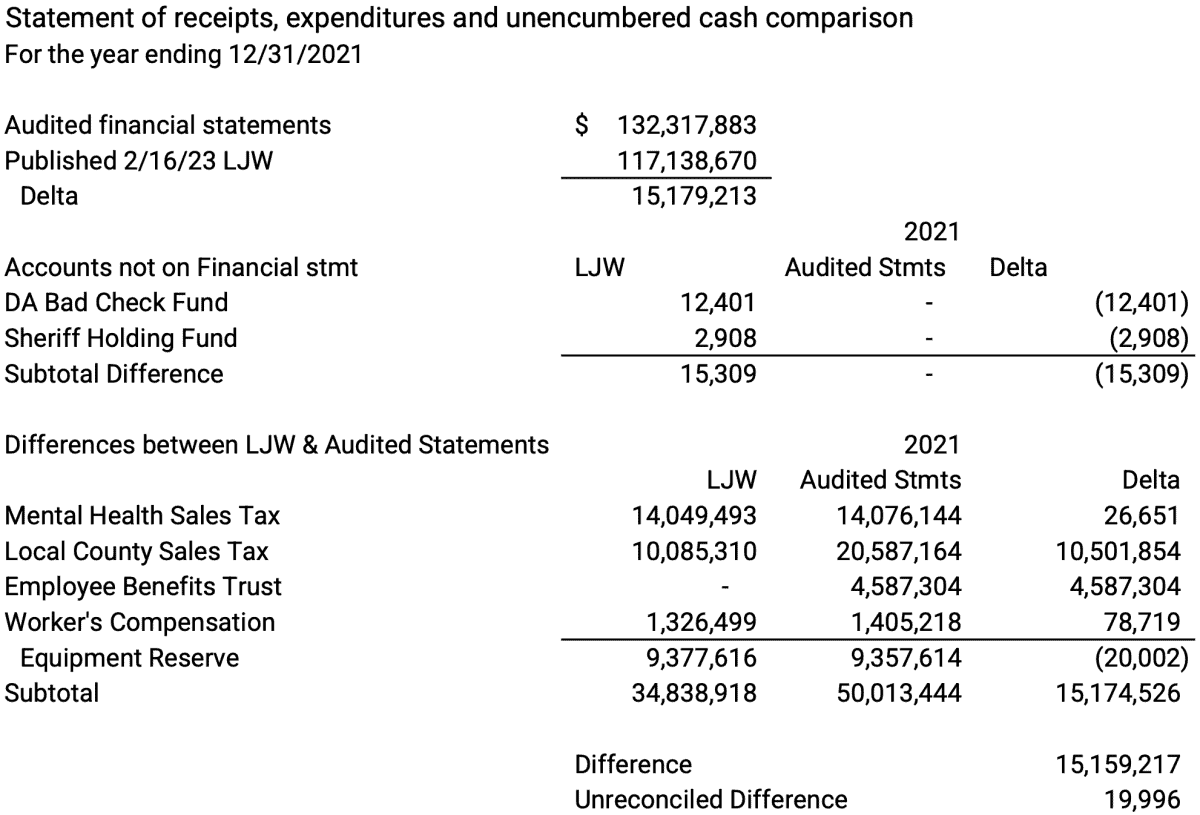

At a recent meeting of the county commission to discuss an audit of the 2023 budget, Boeve, who is also a financial analyst, says the budget and actual expenditures matched that year, but he questions why prior budgets did not and has provided documents to commissioners:

“What is a certified budget? Every other year from 2017-2022 shows significant differences between the certified budget and actual expenditures. It appears to be a misstatement on these financial statements.”

Boeve provided The Sentinel analysis of budget years 2021 and 2022 to illustrate his concern. The figures represent the budget printed in the Lawrence Journal-World compared to actual expenditures. “Delta” is a mathematical term for the difference in the two amounts:

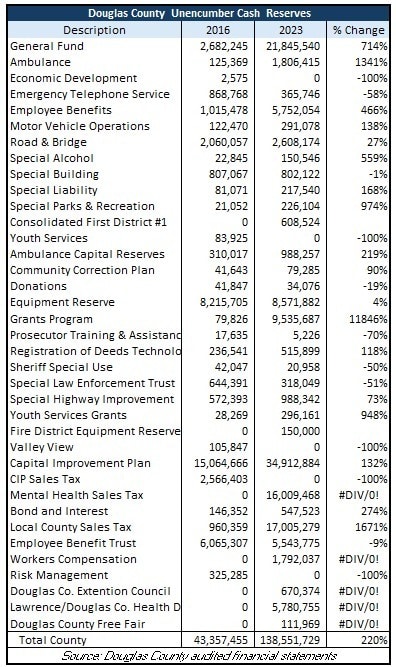

Audited Douglas County financial statements for 2016 and 2023 show large spending increases and even greater increases in cash balances, signaling that county commissioners are grossly overtaxing residents and businesses. General Fund spending jumped 51%, and total county spending increased by 44%. Inflation was 25%.

Douglas County used tax hikes to add $90 million to reserves

Total unencumbered cash reserves spiked by 220%, going from $43 million to more than $138 million. Increases in cash balances indicate the county is taking in a lot more than it spends.

Another podcast featured Boeve, with 34 years as a financial analyst, discussing the lack of transparency in the county commission. He provided responses from Public Information Officer Karrey Britt to his recent Kansas Open Records Act (KORA) requests:

Douglas County does not have responsive records regarding your KORA request for unaudited 2023 financial information. Please let me know if I can be of further assistance. Thank you.

Several weeks later, Boeve tried again and received this reply:

The requested statements and schedules are exempt from disclosure under K.S.A. 45-221(a)(20), and we may decline the request on that basis. The final audited statements will be published in a few weeks and available to the public. Please let me know if I can be of further assistance. Thank you.

The Sentinel was able to get a response when we relayed Mr. Boeve’s concerns about the county’s fiscal operation to each of the three commissioners: Karen Willey, Shannon Reid, and Patrick Kelly. Again, from PIO Britt:

“There have been public meetings and information posted on our website about the budget. Commissioners have publicly discussed the budget, and the recordings of those meetings are on the county’s YouTube channel. Please let me know if you have any specific questions and/or if I can be of assistance.”

Boeve says the responsibility lies at the feet of Douglas county leadership:

“This group of county commissioners (has) been overseeing record property tax increases and record budgets for the last three years. Everybody in this county has “skin in the game,” and everyone in the county should understand that these three and the county administrator (Sarah Plinsky) are responsible for the mess we’re in.”