(The Sentinel) — Residents in the Kansas City suburb of Merriam recently received a postcard informing them of a “clerical error” that will reduce property tax revenue next year.

According to the city’s website, the Merriam City Council voted to reduce the city mill rate by 0.25 mills, but the clerical error is forcing a reduction of 4.48 mills. One mill is equal to $1 for each $1,000 of assessed valuation. State law allows budgets to be modified, but property tax cannot be changed in the revision, and Truth in Taxation laws very specifically establish parameters for changing mill rates.

“When submitting the 2024 budget to the county and the state, we used a new form specific to special financing districts,’ the site reads. “Merriam has a significant portion of the I-35 corridor in one of these special financing districts (you may have heard us refer to them as TIF or tax increment financing districts). Revenue for special financing districts is usually accounted for in a different part of the budget than regular revenue, but with the form we used, it should have been calculated together, and it wasn’t. Therefore, the total property tax revenue that was calculated was incorrect. We were focused on making sure the decreased mill levy rate number was correct on the form and we missed other needed updates.”

The city admits that there will be no reduction in services, and it will simply move several capital projects to later in the year.

“For the last several years the City has intentionally brought in more revenue than it spends in anticipation of constructing the Upper Turkey Creek project in partnership with the US Army Corp(sic.) of Engineers and the Johnson County Stormwater Management program,” the website reads. “This project, currently in the design/engineering phase could easily exceed a total project cost of $100 million. Of that, Merriam’s obligation could exceed tens of millions of dollars. While the City maintains a highly coveted AAA Bond rating, it remains a city priority to cash-finance capital projects, when possible, to avoid amassing municipal debt and its associated costs. The missing property tax revenue in 2024 will strain our budget, but due to some cost savings in 2023, deferred capital outlay purchases and adequate reserves, we believe we can maintain service levels for the year.”

The Sentinel reached out to Merriam City Administrator Chris Engel with several questions, but he did not respond.

One question concerns this statement on the postcard:

“Based on common-sense projections, maintaining the service levels our residents deserve and expect will be impossible at the 2024 mill levy rate. We don’t know how much the mill rate will need to increase, but it will need to be increased unless service levels are to be reduced.”

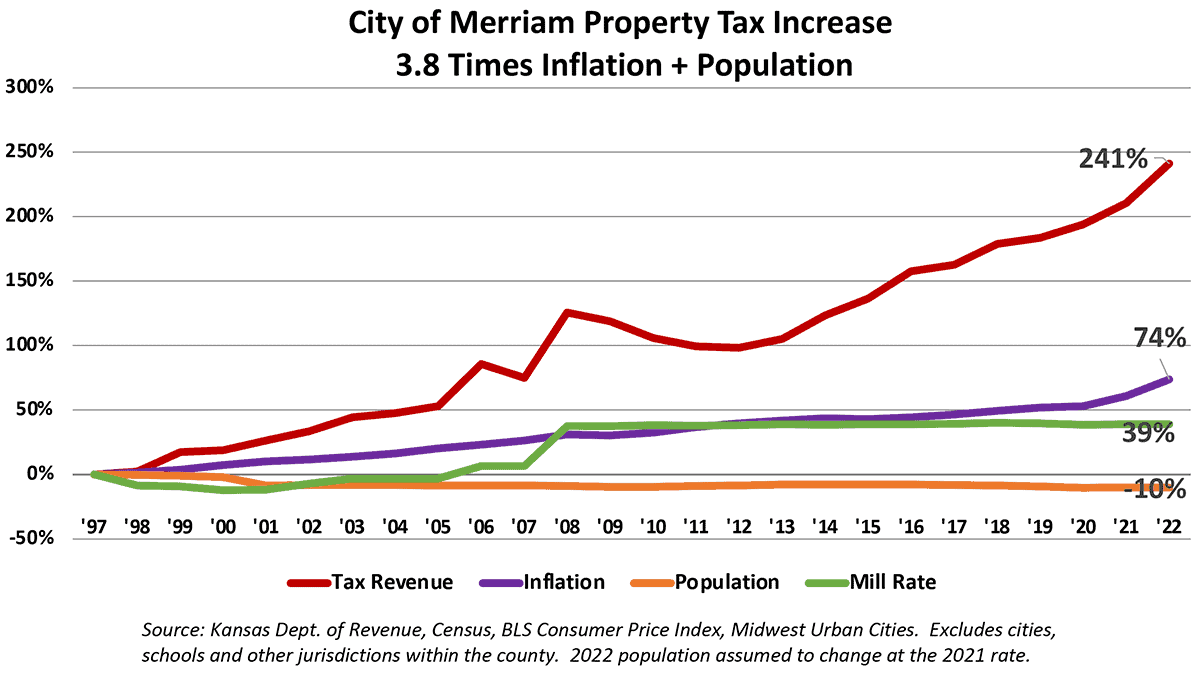

Since 1997, Merriam City Council increased property tax by 241% with a 10% population decline and inflation at 74%. That makes the tax increase almost four times the combined rates of inflation and population. Threatening a service cut would mean Merriam has no inefficient or unnecessary spending and that is unlikely to be the case unless city officials have been using performance-based budgeting with fidelity for many years.

Dave Trabert, CEO of the Sentinel’s parent company, Kansas Policy Institute, says budget figures indicate Merriam’s operating spending has been growing more than necessary.

“A review of Merriam’s budget shows significant increases in General Fund expenditures in recent years. Between 2017 and the 2024 budget, spending increased 62% while the population was declining and inflation will be approximately 28%. Merriam officials could cut back on unnecessary spending in the General Fund and other areas of the budget without raising property taxes if they put taxpayers’ needs ahead of growing government.”