(The Center Square) – Lawmakers face a tough decision this year: hike the national debt to extend the Trump-era tax cuts or let them expire and watch Americans’ taxes spike.

With a government shutdown recently avoided, Republicans have turned their attention to President Donald Trump’s agenda, especially his tax cuts. Though a vote is not expected imminently, Republicans, and particularly Republican Congressional leadership, are tasked with passing President Donald Trump’s “big, beautiful bill.”

“The House is determined to send the president one big, beautiful bill that secures our border, keeps taxes low for families and job creators, grows our economy, restores American energy dominance, brings back peace through strength, and makes government more efficient and more accountable to the American people,” a broad coalition of House Republican Congressional leadership said in a joint statement Monday.

The Tax Cuts and Jobs Act passed in 2017 during Trump’s first term included several key provisions that will expire at the end of this year, which specifically include:

- The child tax credit will be cut in half, from $2,000 per child to $1,000 per child, and the salary where the benefit begins to phase out decreases as well.

- The standard deduction, which was roughly doubled under the Trump tax cuts bill, would be cut in half.

- The $10,000 cap on SALT (State and Local Taxes) deductions would expire. SALT tax deductions allow residents, particularly wealthier Americans in higher tax states like New York and California, to deduct state and local tax payments on their federal taxes. Trump’s tax cuts limited how much those paying high state taxes can deduct, making them pay more federal taxes, but that $10,000 cap would expire at the end of this year.

- The “pass-through” deduction for small businesses is complicated, but it allowed small businesses and sole proprietors in particular to deduct 20% of their business income and as a result pay significantly lower taxes.

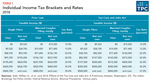

- Federal tax brackets would revert to their higher tax rates, sometimes with lower salaries needed to hit the higher tax bracket. The chart below from the Tax Policy Center shows the changes when the law was passed, though exact salary numbers can change because of inflation adjustments:

Tax Policy Center chart shows tax brackets before and after 2017 Tax Cuts and Jobs Act.

The corporate tax rate reduction from 35% to 21% in that same bill does not expire.

However, at the end of 2025, the expansion of the child tax credit, higher standard deduction, lower tax bracket rates and more expire unless lawmakers extend all or some combination of them.

Lawmakers voted earlier this month to pass a Continuing Resolution that keeps the government running into September, buying lawmakers time to pass appropriations bills, though whether they can actually do so remains to be seen.

Those Trump-era tax cuts have been the center of Congressional debate over spending as the national debt continues to increase and the deficit this year is on track to hit $2 trillion.

Trump has proposed a flurry of spending cuts through his Department of Government Efficiency, but so far the proposed cuts are not nearly enough to cover the cost of making Trump’s tax cuts permanent or even temporarily extending them.

The Committee for a Responsible Federal Budget predicts that extending Trump’s 2017 tax cuts to 2035 would cost between $3.9 trillion and $4.8 trillion.

The national debt is currently over $36 trillion. The U.S. Congressional Budget Office recently said the deficit for this fiscal year is on track to top $2 trillion.

Before the COVID-19 pandemic, federal deficits did not top $1 trillion. Since COVID began, federal deficits have regularly topped $1 trillion and at times $2 trillion.

Proponents of the tax cuts point to the potential for stimulating economic growth and removing burdens from individuals and business wonders, allowing them to invest or hire more people.

“If Democrats get their way and the Trump-Pence tax cuts aren’t extended, every American will be hit with a tax hike,” Tim Chapman, President of Advancing American Freedom, which provided an exclusive memo on the issue, told The Center Square. “Critical provisions from the standard deduction to tax treatment of small businesses and family farms are set to expire at the end of the year. The sooner that Congress takes steps to make these provisions permanent, the better for American families and the American economy.”

Notably, according to CRFB, Trump’s other proposed tax cuts, such as cutting tax on tips, tax on social security, tax on overtime, SALT tax relief and more, would cost between $5 trillion to $11.2 trillion by 2035.

Trump promised in his joint address to Congress to balance the federal budget, but given his proposed tax cuts, experts are doubtful.

Trump has pointed to his tariffs as key to generating revenue. Balancing the federal budget would require several trillion dollars in tariff or other tax revenue as well as major spending cuts, but whether either or both can materialize is the trillion-dollar question.