“The rich tradition and history of the Chiefs are beloved across the entire Kansas City region and throughout Kansas. The potential to establish a home for the Chiefs family here on the Kansas side of the state line is an opportunity that deserves a thorough conversation. We have reached out to the Chiefs organization and asked them to weigh in on the possibility of using Kansas’ unique STAR Bond funding tool and explore what that collaboration could hold. We’re excited that the Chiefs are open to this conversation and look forward to seeing what mutually beneficial opportunities might lie ahead for both the people of Kansas and the Chiefs franchise.”

(The Sentinel) — With that joint statement, Kansas Senate President Ty Masterson and House Speaker Dan Hawkins fired the first salvo in what may be a new Border War with Missouri, opening a “conversation” in the upcoming Special Session of the legislature with the goal of enticing the defending Super Bowl Champion Chiefs away from Missouri, the team’s home since 1963.

In a letter to Chiefs Owner Clark Hunt, the legislative leaders offered Sales Tax and Revenue (STAR) Bonds to finance the project, which would include the construction of a new stadium and other incentives:

The Professional Sports Franchise STAR Bond Project represents, in our view, the best economic development partnership the franchise will find in America. With our strategic location, a vibrant fan base, robust economic incentives, and the exceptional tools at our disposal, we are poised to make the Kansas City Chiefs even stronger. With the potential for a substantial return on investment, far surpassing the initial outlay, it also promises to be a victory for Kansas taxpayers and a game-changer for our state’s economy.

STAR Bonds are administered by the Kansas Department of Commerce and intended to finance the development of commercial, entertainment, and tourist destinations. Bond owners are paid from sales tax revenue generated from the project.

Proposed subsidy to lure Chiefs has sketchy track record

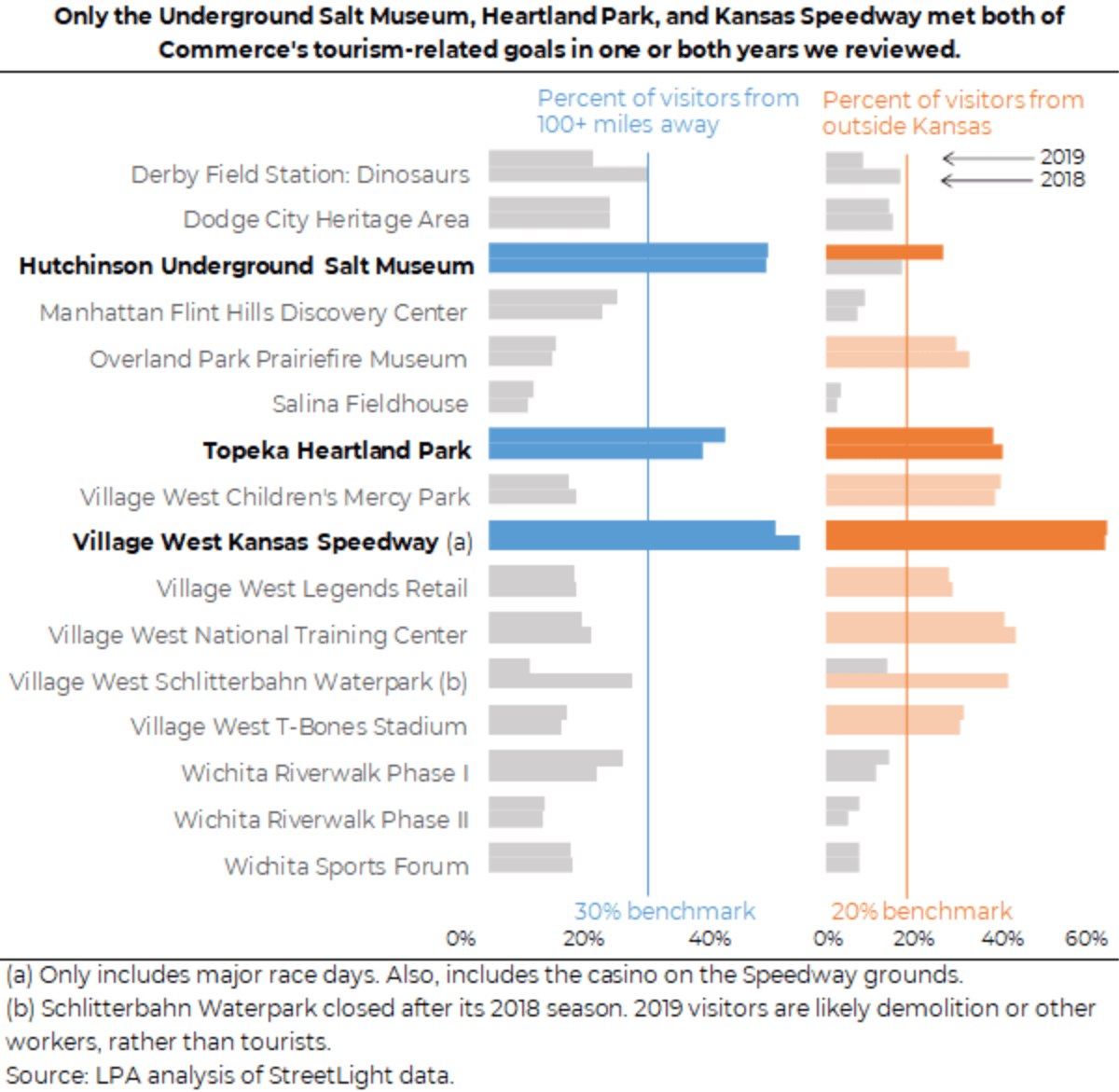

A 2021 analysis by Kansas Legislative Post-Audit (LPA) the auditing arm of the Kansas Legislature, showed only three of the 16 approved STAR Bonds projects (The Hutchinson Underground Salt Museum, Topeka Heartland Park, and Village West Kansas Speedway) have met the Commerce Department’s goals of attracting in-state visitors from 100 miles away, and out-of-state tourists.

Some STAR bond projects end up costing taxpayers more money.

Research by Ganon Evans of the Kansas Policy Institute, owners of The Sentinel, shows for all the publicity generated by new stadium construction financed in part by taxpayer subsidies, the economic impact is overstated:

“Stadium subsidies have a track record worse than the Chicago White Sox. The Brookings Institution found no examples of a new, subsidized sports facility increasing higher local tax revenues or having a significant, positive effect on local employment. A separate study from the Journal of Urban Affairs found no effect of subsidized basketball stadiums on regional personal income. Between 1995 and 2015, 29 of the NFL’s 31 stadiums received a total of $7 billion in public subsidies, only to have practically nonexistent income or job growth in the long run.

Apart from stadium construction, Evans contends that state subsidies to private companies writ large don’t provide the “bang for the buck” for Kansas taxpayers:

“Time and time again, the results are that these corporate handouts fail to provide significant results at the expense of the taxpayer. In a 2020 KPI report analyzing STAR Bonds in Wichita, the subsidies “had no measurable effect on the persistent decline of business and job growth in downtown Wichita.” A 2017 analysis by Nathan Jensen with the Kauffman Foundation found that there was little evidence that Kansas PEAK bond recipients experienced a significant boost in employment compared to non-peak recipients. Jensen recently reported that 75% of companies awarded incentives in the Kansas City area would have made “similar investment regardless of the public subsidy.” The cost of these failures is that Kansas has the highest effective tax rates on mature businesses.”

Another critic of the Kansas gambit for the Chiefs is Elizabeth Patton, State Director for Americans for Prosperity – Kansas. She argues it’s not only bad policy but faults the misplaced priorities of the legislature:

“The Kansas City Chiefs, or any business, has the ability to use the existing STAR Bond program to come to Kansas under current statute. AFP-Kansas has long opposed the STAR Bond program itself and any expansion of it because of its inability to demonstrate meaningful economic growth for our state, lack of transparency, and putting taxpayers on the hook for risky financial investments.

“STAR Bond projects have a reputation of defaulting, and if there were truly no risk to taxpayers, we likely wouldn’t see major investors as there wouldn’t be a backstop to their money. There are many questions to be answered and implications of this legislation; at the minimum, a bill of this magnitude ought to be properly vetted in January during the regular legislative process. During special session, lawmakers should remain laser-focused on providing as much meaningful tax relief to Kansas families as possible.”

The Special Session of the legislature convenes on June 18th.