(The Sentinel) — As if taking away $1.4 billion in tax relief from Kansans wasn’t bad enough, Governor Laura Kelly Friday vetoed Senate Bill 8 (SB 8), which would have provided $244 million in tax relief over the first three years.

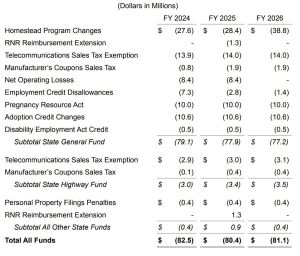

The Conference Committee Report Brief on SB 8 says its major components include:

- Increase the value of the Homestead Property Tax Refund

- Create a sales tax exemption for equipment and other infrastructure to provide internet access

- Allowing net operating losses in tax years 2018 through 2020 pursuant to the COVID CARES Act to carry forward for up to 20 years.

- Enact subtraction modifications in determining Kansas adjusted gross income equal to 100% of the amount of the federal disallowance related to the Work Opportunity Tax Credit.

- Tax credits for contributions to nonprofit pregnancy centers or resident maternity centers

- Increase the adoption tax credit from 25% to 75% of the federal adoption tax credit for most children and from 25% to 100% if the child is special needs.

SB 8 also included the contents of SB 252, which gave property and sales tax credits to fitness centers, restaurants, and other businesses that compete with government. There was no fiscal note estimate of the cost, so it is not included in the summary below.

Source: KLRD, CCRB on SB 8

Source: KLRD, CCRB on SB 8

Kelly’s veto message was loaded with misrepresentations.

“After years of fiscal mismanagement and budget deficits, I am proud that we have balanced the budget four years in a row. As a result, we have seen record economic growth and have delivered over $1 billion in tax cuts for working families, property owners, veterans, farmers, and ranchers.”

The Kansas budget has been balanced for many years, not just the last four. State law requires a balanced budget, meaning the budget must have a positive ending balance, and the only time in recent history that didn’t happen was Fiscal Year 2010 when Democrat Mark Parkinson was governor.

‘Record economic growth’ is hardly the appropriate description for a state that lost private-sector jobs in the last two months, ranked #39 in economic performance, and last year was #38 in private nonfarm earnings.

And Kelly vetoed that $1 billion in tax relief in 2021 she mentioned; the Legislature had to override her.

She didn’t give a specific reason for her veto but merely said, ” While Senate Bill 8 includes tax cuts and personal property tax reforms that I support, by bundling 12 bills together the legislature has made it impossible to sort out the bad from the good.”

Legislators react

Reaction from legislative leaders was fast and furious.

Speaker of the House Dan Hawkins (R-Wichita) issued a release entitled, “Oops, They Did It Again.”

“The Kelly/Toland Administration has once again “axed” the tax cuts and vetoed SB8, therefore killing important tax policy that would help veterans, the disabled community, and spur the Kansas economy all because of their irrational focus and political bias against helping vulnerable new mothers.”

Senate President Ty Masterson echoed Hawkins, adding “Today’s vetos are not surprising and further evidence that the Kelly/Toland Administration is now governing from the radical left and marching in tandem with Joe Biden.”

Masterson added that “it is certainly bad news for the vast majority of Kansans who expected her to keep her word to meet us in the middle.”

There will be no veto override attempt because the Legislature is adjourned for the year.