The Biden administration has announced a racial preference scheme to govern the application and enforcement of the federal tax code and other aspects of the economy, all in pursuit of “equity.”

In October of 2021, the Treasury secretary appointed the department’s first Counselor on Racial Equity, tasked with “advancing equity” through all “offices and workstreams” in the Treasury Department.

Couched in reparative terminology, the policy intends to identify equity deficiencies to facilitate injecting “equity” in all processes, including budget formation and tax policy.

Under the heading “Barriers to Equitable Outcomes,” the new plan says:

“The pandemic revealed the racial disparities that have persisted in this country for far too long. Black, Latino, and Native Americans were more likely to be infected, hospitalized, or die from COVID-19 than their white counterparts. Communities of color were forced to bear a double burden in this pandemic: both more likely to work in essential, frontline roles with a higher risk of exposure and more likely to lose those jobs as the pandemic caused the economy to contract.”

The policy document makes no pretense of considering any other cause for the disparities in outcomes, aside from systemic racism.

Despite evidence from the CDC revealing the impact disparity of COVID-19 had more to do with socio-economic drivers than race – factors that applied equally to similarly situated whites and other minorities – the policy nonetheless forges ahead, arguably under a fundamental misapprehension of the issue it intends to address.

The document does touch on economic realities, but only to establish the existence of a “wealth gap” between races, which the writers attribute, again, to systemic racism.

The writers assert the added pressure of COVID-19 merely exacerbated the existing disparities, and didn’t consider the possibility that the the disparities may have been made worse by the heavy-handed response to COVID-19.

COVID-19 response measures did indeed have a disparate impact on families of color, as urban public schools shut down, forcing many one-parent families to abandon the workforce altogether to care for their children.

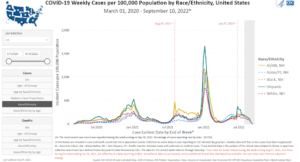

The above graph shows that Hispanic populations experienced far worse outcomes than either Blacks or other minorities relative to COVID-19. Many argue this suggests systemic racism is an incidental, not primary factor, given the comparable socio-economic status of Blacks and Latino populations.

The $1.9 trillion American Rescue Plan gives managerial control over more than $1 trillion to the Treasury Department, which proudly announces it “represents an opportunity to advance equity through both immediate recovery efforts and lasting, generational investments in vulnerable communities across the country.”

The Treasury’s 2022-2026 Strategic Plan is the vehicle by which the department intends to establish a largely separate financial system designed to “Promote equitable financial recovery and growth through support and flow of capital to small businesses, households, and underserved communities.”

The new directive unambiguously establishes a spoils system for racial minorities in all aspects of the economy, from housing, to employment, to taxation.

“An analysis of how the tax code affects different race and ethnic groups is central to understanding the consequences, both intended and unintended, of our tax laws,” reads the policy document. “This improved understanding can be used to both shape tax policy design at the inception of legislative efforts and to better implement current laws.”

The IRS is legally prohibited from accessing demographic information specific to individual taxpayers, which presents a significant obstacle to birthing the Treasury Department’s plan. However, that legal prohibition will be sidestepped, as the document helpfully points out.

“Recognizing these limitations [privacy protections in law], [The Office of Tax Policy] is researching statistically valid alternatives for developing demographic data while respecting privacy concerns and civil rights. These include: 1) developing reliable methods to impute race and ethnicity for tax data, 2) partnering with other data producers to obtain data on race and ethnicity to validate the statistical imputations when legally feasible, and 3) when microdata cannot be obtained, partnering with other data producers to obtain tabulated data that include race and ethnicity for both analysis and to validate imputations.”

Though it’s illegal to access Census Bureau data or to require its disclosure as part of individual tax returns, there appears to be no prohibition against guessing at it, then accessing the prohibited data as a means of “validating” those guesses.

Privacy protections for American taxpayers are intended to forestall illegitimate uses of their personal information. Many argue eliminating or sidestepping those protections to facilitate the construction of a parallel tax and monetary system advantageous to racial minorities would end up with a robust legal challenge.