(The Center Square) – A report from the Tax Foundation finds Missouri’s tax rate for businesses to be among the lowest in the nation, but the state can still improve its competitiveness.

Jared Walczak, vice president of state projects at the Tax Foundation, said Missouri’s tax structure is especially attractive to new industries and a wide range of sectors.

“Rates tell you a lot and they’re really important, but the structure is deeply important to the investments that businesses make,” Walczak said during a briefing with Republican Gov. Mike Parson, director of Revenue Wayne Wallingford and Subash Alias, executive director of the Missouri Partnership. “You want a neutral tax code, a pro-growth tax code.”

The report, Missouri’s Tax Competitiveness, found Missouri’s corporate tax costs rank 10th-best of the 50 states for new firms and 18th for mature firms. It stated tax reforms implemented in 2020 cut the state’s corporate income tax rate from 6.25 to 4%, the nation’s second-lowest rate. Missouri allows 50% of federal income tax payments to be deducted when calculating taxable income, according to the report.

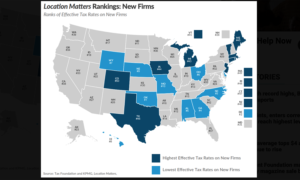

Information for the Missouri report was first published in the Tax Foundation publication, Location Matters. It compared corporate tax costs in all 50 states and examined eight types of businesses. Each business type was modeled twice – as a new business eligible for tax incentives and as a mature operation ineligible for incentives.

Missouri stood out in labor-intensive manufacturing operations, rating fourth for new businesses in the sector and 11th for mature businesses. The report stated new firms get tax credits and property tax abatements while all firms benefit from tax structure provisions.

“The amount of investment depends on the attractiveness of investment in a state,” said Wallingford, a former Republican senator and representative. “So cutting the corporate tax rate is a good place to reform our climate so we can get businesses to invest here. Lower tax rates are associated with more rapid growth, while higher tax rates actually depress income and output.”

Tax Foundation research found two neighboring states – Nebraska and Oklahoma – provide more competitive overall tax rates to newly established firms, while four of Missouri’s eight border states – Kentucky, Nebraska, Oklahoma, and Tennessee – outperform Missouri in rates on mature firms.

“Businesses are going to look at tax structure to see what it’s like to operate a business here,” Parson said.

In addition to the corporate tax rate, Parson and Walczak said prospective companies also take into account the personal income tax rate and other taxes when considering a move.

“You want a [tax code] that gets out of the way of economic decision making,” Walczak said. “It raises the requisite revenue, but it’s not in the business of deciding the wrong things, essentially, and getting in the way of businesses.”

State Rep. Sarah Unsicker, D-Shrewsbury and the minority caucus policy chair, questioned the promotion of tax policies when she said the state is failing to adequately deliver basic services. People can’t apply for food stamps because the state call center must close each day at 6 p.m. so computers can process daily entries, Unsicker wrote on social media. She said Medicaid applications are taking an average of 99 days for acceptance due to poor information technology. She also said people are getting penalized for missing state unemployment appointments because information wasn’t sent to recipients.

“When we tout ‘low taxes,’ this is the result,” Unsicker wrote. “Yes, we are planning computer upgrades, but we are in a crisis NOW. The most well-intentioned public servants can’t work well with bad systems.”

The Tax Foundation report stated there’s still room for improvement in Missouri’s tax structure, but the state’s positioning itself as an “attractive location for business investment. And as ongoing reforms further enhance the competitiveness of the state’s tax code, more businesses will take notice.”

In addition to tax structure and location, Alias, with the Missouri Partnership, said businesses also consider the proximity of suppliers and vendors, along with the business climate.

“There’s also quality of life and why we love living in Missouri – cultural resources, recreational amenities, supporting teams and things like that,” Alias said.