(The Center Square) – The charitable contributions to more than 100 nonprofit organizations throughout Missouri will be enhanced by a $17.7 million tax credit program.

Missouri’s Department of Economic Development on Aug. 10 announced 104 nonprofits received eligibility for 50% and 70% tax credits through its neighborhood assistance program (NAP) and youth opportunities program (YOP). Donors will receive a state tax credit after they make a donation to the nonprofit and complete other program requirements.

“Missouri nonprofits have gone above and beyond to provide critical services to Missourians throughout the past year,” Gov. Mike Parson said in a statement. “This program provides support to these organizations as they continue their great work to serve Missouri’s at-risk youth and cultivate strong, productive communities.”

The NAP and YOP Special Cycle was created to assist nonprofits and other entities providing services to at-risk populations, prioritizing those serving youth. Many nonprofits report the pandemic continues to adversely affect the mental health of clients, especially children.

“Last year was definitely difficult because of COVID and everyone was struggling,” said Laura Kleffner, vice president of development for Mission: St. Louis, which is receiving $150,860 in YOP tax credits. “We weren’t sure what school was going to look like with virtual learning. These funds have been great for us because we know we will be able to help a fair amount of students with catching up.”

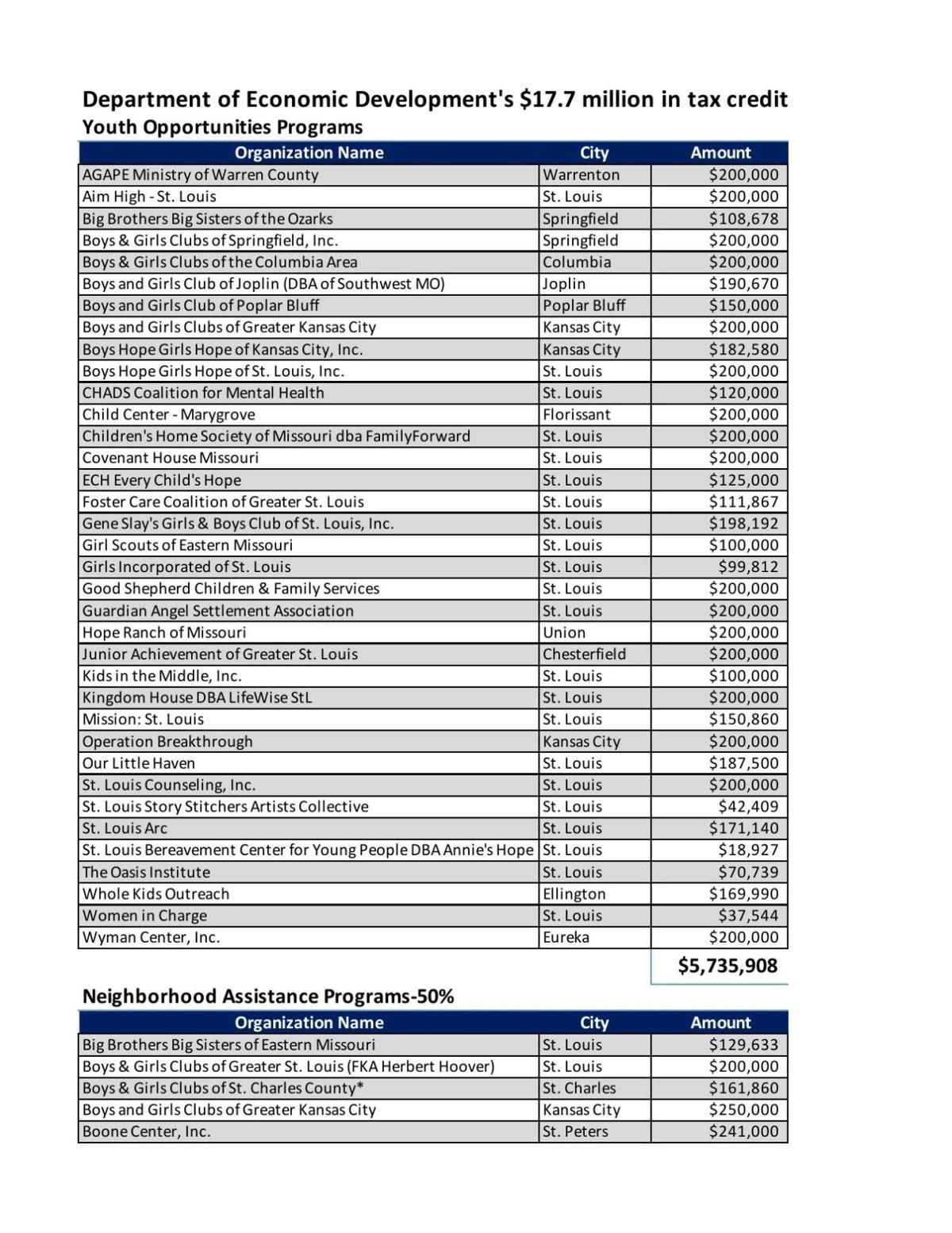

Mission: St. Louis and 35 other nonprofits will receive a portion of $5,735,908 for the YOP. The average amount of tax credits awarded to each organization is $159,331.

“We help students, or scholars as we like to call them, get up to grade level for math and literacy,” Kleffner said. “These tax credits are instrumental in getting donors to give and then using those funds to help St. Louis students get better at math, literacy and science.”

Job training programs and crime prevention, along with a wide range of community needs, will be assisted with additional NAP and YOP tax credits. Springfield’s Victory Mission will receive $250,000 in NAP tax credits for its workforce development program.

“It really prepares men and women for lifelong work with a career mentality,” said Mindy McDonald, marketing director for Victory Mission. “We also have a three-day intensive bootcamp for men who are staying at our emergency shelter. We have a number of employers locally who promise them interviews and it’s really helping out with the worker shortage.”

Victory Mission and 51 other organizations will receive a portion of $7,835,243, for a 50% tax credit with the average amount of tax credits to be awarded to each organization at $150,678. Sixteen organizations will receive a portion of $4,165,091 for a 70% tax credit with the average amount of tax credits to be awarded each organization at $260,318.

“Having a thriving economy requires having thriving communities,” Rob Dixon, director of the department of economic development, said in a statement announcing the tax credits. “That begins with dedicated organizations like these that provide vital services for our citizens and communities. Strong communities help bring more opportunities for our citizens, and we all benefit from the great work of these nonprofit organizations.”